Table of Contents

Introduction to Trin Wealth

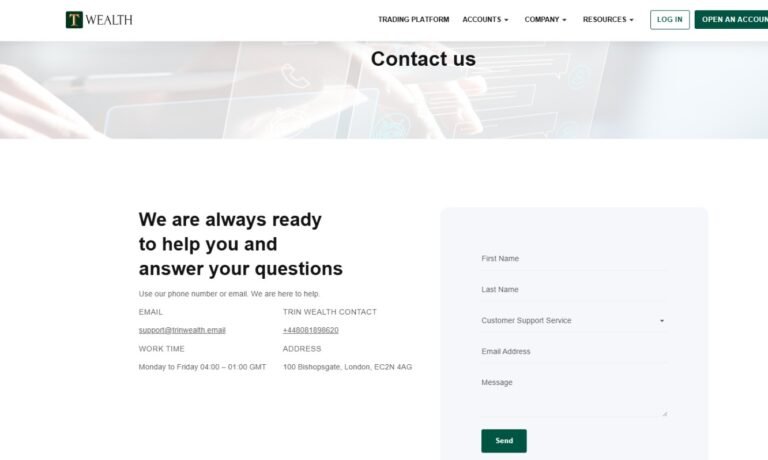

This detailed Trin Wealth review aims to uncover the truth behind the platform’s bold claims. Trin Wealth advertises itself as a global trading platform, allegedly providing access to forex, stocks, and crypto trading opportunities. The broker claims to operate internationally, but its actual registration points to a vague offshore jurisdiction. For investors who have already lost money with this broker or those considering signing up, it’s crucial to ask: is Trin Wealth a scam or a legitimate platform? This Trin Wealth review uncovers all the warning signs you need to know.

Trin Wealth: Regulation & Legal Status

One of the biggest red flags with Trin Wealth is its regulatory status. While the website suggests compliance with international standards, there is no evidence of oversight from top-tier regulators such as the FCA, ASIC, or CySEC. This is a major concern, as unregulated brokers can operate without accountability, leaving investors with no protection in cases of fraud or disputes.

Misleading references to reputable authorities are common among fraudulent brokers, often used to create a false sense of security. Similar tactics have been seen with other unregulated platforms that disappeared after scamming investors. Learn how to spot a scam broker before it’s too late. The lack of oversight raises serious questions about whether Trin Wealth is a scam.

Trading Conditions & Platform Analysis of Trin Wealth

Trin Wealth advertises multiple account types, yet provides little transparency about their exact features. Minimum deposit requirements are high compared to regulated brokers, and the offered leverage seems excessive — a common bait used by shady platforms to lure traders with promises of higher profits. Spreads and fees are also not clearly disclosed, leaving traders in the dark about actual trading costs.

The broker claims to offer popular platforms like MT4 or MT5, but there’s no evidence that these platforms are genuinely supported. Even if MT5 were available, having this software doesn’t guarantee legitimacy. Additionally, there’s no information about liquidity providers or whether the broker operates as an STP/ECN broker. What to check before signing up with a trading platform. These gaps make it harder to dismiss the idea that Trin Wealth might be a fraud.

Reputation & User Reviews About Trin Wealth

User reviews play a crucial role in assessing a broker’s credibility. On platforms like TrustPilot and Forex Peace Army, there are multiple complaints about withdrawal issues, poor customer service, and account freezes. Many reviews also appear fake — overly positive and generic, likely written to drown out genuine complaints.

Traffic analysis using tools like SimilarWeb suggests that Trin Wealth receives minimal web traffic, which is unusual for a legitimate broker. This lack of organic user engagement combined with negative feedback strengthens the suspicion that this could be another offshore scam targeting unsuspecting investors.

How to Test Whether Trin Wealth Is a Scam

If you’re unsure about a broker like Trin Wealth, here’s a simple checklist to test its legitimacy:

- Check for regulation: Verify any licenses with authorities like FCA, ASIC, or CySEC.

- Look for red flags: Be cautious if license details are missing, vague, or unverifiable.

- Read real reviews: Use independent platforms like TrustPilot or Forex Peace Army to spot patterns of complaints.

- Test the platform: Poor design or proprietary platforms without transparency often indicate scams.

- Review withdrawal terms: Be wary if the broker only supports crypto withdrawals or hides payout policies.

- Watch for false promises: Guaranteed returns and “risk-free” trading claims are classic fraud tactics.

- Try the demo account: Genuine brokers allow demo testing without mandatory deposits.

Final Verdict & Alternatives

Based on our findings, Trin Wealth raises too many red flags to be considered a safe broker. Its lack of regulatory oversight, poor transparency, and numerous complaints from users make it an extremely high-risk choice. We recommend avoiding this platform altogether.

For safer alternatives, consider trading only with licensed and regulated brokers overseen by authorities such as FCA, ASIC, or CySEC. These platforms provide better investor protection, transparent operations, and reliable dispute resolution.

When it comes to online trading, remember: if it sounds too good to be true, it probably is.