Table of Contents

Introduction to Prop Firm Match

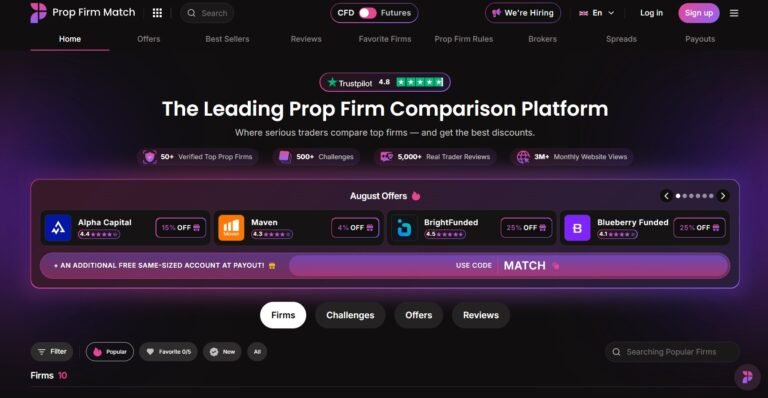

This detailed Prop Firm Match review dives deep into the prop trading firm’s operations, exposing whether it’s a trustworthy service or a cleverly disguised scam. Prop Firm Match claims to offer aspiring traders a funded account opportunity without risking their own capital. The firm appears to operate globally and is reportedly registered in an offshore jurisdiction.

However, traders have started asking an important question: is Prop Firm Match a scam or a legitimate platform that truly funds traders? This article was written for two types of readers—those who feel they’ve been scammed and are looking for answers, and those suspicious of the platform and searching for solid research before risking their money. This Prop Firm Match review uncovers all the warning signs you need to know.

Prop Firm Match: Regulation & Legal Status

One of the most concerning aspects about Prop Firm Match is its regulatory status—or lack thereof. Based on available data, the firm does not appear to be regulated by any recognized financial authority such as the SEC, FCA, or ASIC. Instead, it seems to operate through a loosely registered offshore entity with minimal oversight.

This is a critical red flag. Unregulated prop firms operate without accountability, meaning client funds are at risk with no safety net. They can change terms, delay payouts, or terminate accounts without explanation or legal consequences.

Worryingly, some brokers or firms use vague references to respected authorities to appear legitimate when, in reality, no such oversight exists. We’ve seen similar tactics in other prop trading scams, where traders pass the challenge but are never funded—or worse, never paid. Learn how to spot a scam broker before it’s too late.

The lack of proper licensing raises serious concerns about whether Prop Firm Match is a scam hiding behind a promising business model.

Trading Conditions & Platform Analysis of Prop Firm Match

Prop Firm Match offers various account challenges, where traders must pass certain profit targets under strict conditions to qualify for a funded account. On the surface, this seems fair. However, many users report issues with unrealistic expectations, vague rules, and inconsistent evaluations.

There’s minimal transparency regarding which trading platforms are used, whether they offer real market execution, or if trading is simulated. They may use MetaTrader 4 or 5, but this is not proof of legitimacy. Any broker or prop firm can rent an MT5 license.

Additionally, there is no clear disclosure about the firm’s liquidity providers or whether trades are placed in the real market. Some users claim their trades are not executed as expected, raising suspicions that this is more of a gamified challenge than actual trading.

Without clarity on execution, fees, spreads, or leverage limits, trusting the platform becomes difficult. What to check before signing up with a trading platform includes understanding the backend of the service, which Prop Firm Match fails to provide.

These inconsistencies make it harder to dismiss the possibility that Prop Firm Match might be a fraud.

Reputation & User Reviews About Prop Firm Match

User reviews on platforms like TrustPilot are mixed. While there are a handful of glowing reviews, many seem generic and potentially fake. This tactic is common among scam firms to build false credibility.

More troubling are detailed complaints from users who passed the trading challenge but were denied funding without explanation, or had their accounts closed for “rule violations” that were never clearly defined.

Some traders also claim that customer support is slow or non-existent once you reach payout stages. This aligns with common fraudulent tactics where firms are responsive during onboarding but disappear when it’s time to release money.

As of now, traffic analysis tools like SimilarWeb do not show significant engagement, suggesting that Prop Firm Match may be relatively unknown—or intentionally flying under the radar to avoid regulatory attention.

How to Test Whether Prop Firm Match Is a Scam

If you suspect Prop Firm Match is a scam, here are the steps you should take to confirm its legitimacy:

- Regulation Check: Search the company’s name on authority databases like SEC or FCA. If there’s no match, that’s a major red flag.

- Review Their Terms: Be wary of overly strict rules or vague language in their funding criteria and refund policies.

- Search Complaints: Use review sites like TrustPilot or Forex Peace Army to read real trader experiences. Look for consistent complaints around funding or payouts.

- Test Their Platform: See if they offer a demo or trial. If not, it might be a sign they’re hiding the real user experience.

- Withdrawal Rules: If you can’t easily find how and when payouts occur—or they only pay in crypto—that’s suspicious.

- Avoid Guaranteed Profit Schemes: No legit firm offers risk-free profits. If their ads promise “easy money,” it’s a scam signal.

- Use External Validators: Check Prop Firm Match on ScamDoc to see how reliable their domain and trust score is.

Remember: just because a site looks professional doesn’t mean it’s safe. Many scams today are well-designed to lure unsuspecting traders.

Final Verdict & Alternatives

After carefully reviewing all the available information, we advise extreme caution. While Prop Firm Match presents itself as an opportunity for traders to access capital, the lack of transparency, unregulated status, and recurring complaints all suggest this may not be a trustworthy provider.

If you’re looking for legitimate prop trading alternatives, consider firms like FTMO, The5ers, or TopStep—well-known companies with a proven track record, clear terms, and actual regulatory oversight.

Finally, if you believe you’ve been scammed, consider filing a complaint at FTC’s fraud report portal or seeking assistance through a consumer protection agency.

Only trade with platforms that offer verified transparency, enforceable regulations, and genuine trader support. Your financial safety depends on it.