Table of Contents

Introduction to Maven Trading

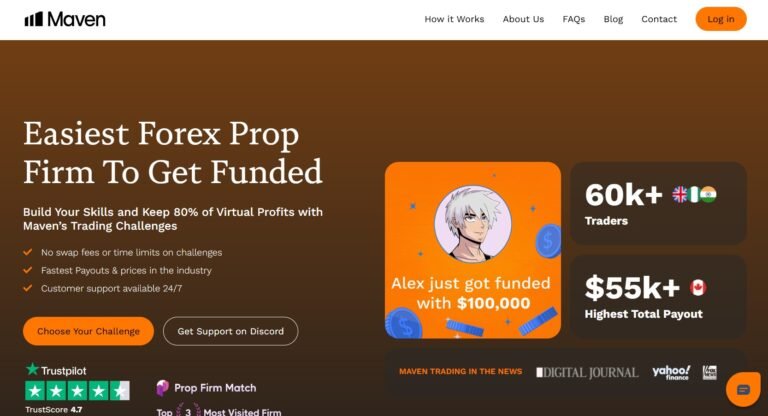

This Maven Trading review provides a detailed analysis of the broker’s services, regulatory claims, and user experiences. Maven Trading promotes itself as a global brokerage offering access to various financial markets, including forex, stocks, and crypto, claiming to be headquartered in a well-known financial hub.

However, numerous reports from traders indicate issues with transparency, withdrawals, and overall trust. This leaves many asking: is Maven Trading a scam or a legitimate platform for trading? This Maven Trading review uncovers all the warning signs you need to know.

Maven Trading: Regulation & Legal Status

One of the most critical aspects of a broker’s credibility is its regulatory status. Maven Trading claims to operate under international standards, but there is no verifiable license from major regulators like the SEC, FCA, or ASIC. Often, unregulated brokers use vague language about “global compliance” to appear more credible than they are.

The lack of proper regulation exposes traders to significant risks, including no client fund protection, no formal dispute resolution, and no independent oversight. These are common tactics used by questionable brokers to lure unsuspecting clients. Learn how to spot a scam broker before it’s too late. The absence of verifiable oversight raises serious questions about whether Maven Trading is a scam.

Trading Conditions & Platform Analysis of Maven Trading

Maven Trading advertises competitive spreads, flexible account types, and advanced trading platforms. However, key details such as minimum deposits, leverage ratios, and liquidity providers remain unclear. Brokers that avoid disclosing such crucial information often do so to prevent scrutiny of their operations.

Although Maven Trading claims to provide a modern platform, having access to well-known platforms like MT5 does not equate to trustworthiness. Without transparency about execution policies or STP/ECN verification, clients are left in the dark about how their trades are handled. What to check before signing up with a trading platform. These missing details make it harder to dismiss the idea that Maven Trading might be a fraud.

Reputation & User Reviews About Maven Trading

User feedback on Maven Trading is mixed at best. While some reviews appear overly positive (possibly fabricated), credible complaints raise concerns about delayed withdrawals, unresponsive support, and aggressive account managers.

On TrustPilot and other review platforms, patterns suggest a combination of fake testimonials and genuine negative experiences. Web analytics data (e.g., SimilarWeb) indicates low traffic and limited engagement, signaling that Maven Trading may not have a substantial active user base.

How to Test Whether Maven Trading Is a Scam

Before committing funds, here are practical steps to evaluate Maven Trading’s legitimacy:

- Verify regulation: Check Maven Trading’s licensing claims with credible authorities like the FCA, SEC, or ASIC.

- Look for red flags: Be cautious of vague license information and lack of verifiable office locations.

- Investigate real user feedback: Read reviews on independent platforms rather than relying on testimonials on their site.

- Test withdrawals: Attempt small withdrawals before depositing larger amounts.

- Review terms: Beware of unclear or crypto-only withdrawal policies.

- Avoid guarantees: Any promises of risk-free or guaranteed returns are highly suspicious.

Final Verdict & Alternatives

Maven Trading’s lack of regulatory oversight, mixed reputation, and absence of transparency in key areas make it a high-risk option for traders. Until the broker provides verifiable licensing and improves its practices, potential clients should approach with extreme caution.

If you’re seeking safer options, consider fully regulated brokers with clear policies, transparent fee structures, and strong investor protections. Trading only with licensed platforms significantly reduces your risk of falling victim to scams.