Table of Contents

Introduction to Knightsbridge FX

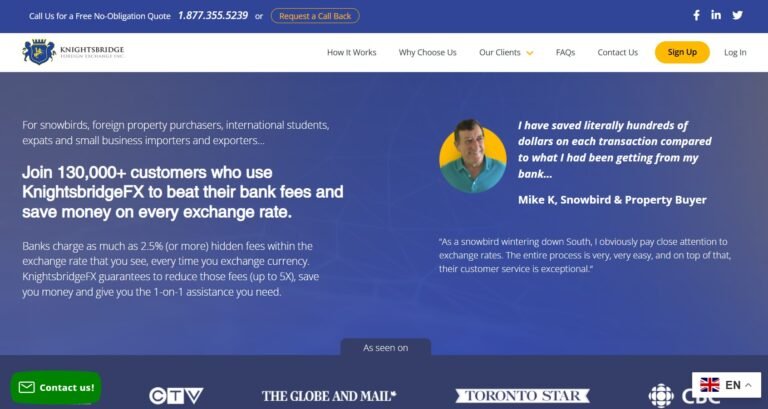

This article provides an in-depth Knightsbridge FX review, addressing growing concerns about the Knightsbridge FX scam allegations. Knightsbridge FX claims to specialize in competitive forex exchange services for personal and business clients, reportedly operating out of Canada.

Yet, many traders are left wondering: is Knightsbridge FX a scam or a legitimate and trustworthy service provider? This Knightsbridge FX review uncovers all the warning signs you need to know before engaging with this broker. We’ve written this for two key audiences: those who may already feel scammed and those questioning whether they should trust Knightsbridge FX with their money.

Knightsbridge FX: Regulation & Legal Status

Knightsbridge FX states that it is a Canadian-based firm. However, based on publicly available information, there is no clear evidence of licensing with Canadian regulatory bodies such as FINTRAC or IIROC. This raises concerns about its operational transparency and accountability.

Brokers often create an illusion of credibility by referencing well-known regulators like the FCA, ASIC, or CySEC. Without verified credentials, clients are exposed to serious risks: no official oversight, no investor protection, and no clear dispute resolution process.

Learn how to spot a scam broker before it’s too late by verifying their licenses through official channels or using platforms like Knightsbridge FX scam validator. The lack of verifiable oversight raises serious questions about whether Knightsbridge FX is a scam.

Trading Conditions & Platform Analysis of Knightsbridge FX

Knightsbridge FX markets itself as a currency exchange service offering competitive rates for individuals and corporations. However, there is limited transparency about fees, rate spreads, or execution methods.

Unlike typical trading brokers, Knightsbridge FX does not appear to provide traditional trading platforms like MT4 or MT5. While this may not be a red flag for a currency exchange business, the absence of detailed disclosures about transaction execution or liquidity partners raises transparency concerns.

Before working with any broker or exchange, review what to check before signing up with a trading platform. These gaps make it harder to dismiss the idea that Knightsbridge FX might be a fraud.

Reputation & User Reviews About Knightsbridge FX

User reviews for Knightsbridge FX appear mixed. While some clients report satisfactory experiences with their exchange services, others have complained about delayed transactions and lack of support.

On platforms like TrustPilot reviews of Knightsbridge FX, it is difficult to verify whether all positive testimonials are authentic. The possibility of fake or incentivized reviews cannot be ignored. Moreover, traffic analytics from SimilarWeb indicate modest online engagement, which does not reflect a high level of trust or widespread adoption.

How to Test Whether Knightsbridge FX Is a Scam

To determine whether Knightsbridge FX is a scam, follow these steps:

- Verify regulation – Check with Canadian authorities like FINTRAC or IIROC to confirm licensing status.

- Look for red flags – Vague licensing information, hidden fees, or aggressive sales tactics are warning signs.

- Read real user reviews – Explore independent forums like Forex Peace Army and consumer complaint boards for authentic feedback.

- Test the service – Engage with smaller transactions first and evaluate transaction speed, customer service, and transparency.

- Review terms carefully – Examine exchange rate policies and withdrawal conditions before sending larger sums.

- Be cautious of false promises – Any guarantee of unbeatable rates or risk-free exchanges should be viewed with skepticism.

Reporting suspicious activity is also an option. If you suspect fraudulent behavior, you can file a complaint through FTC fraud reporting.

Final Verdict & Alternatives

Knightsbridge FX appears to provide legitimate currency exchange services but falls short on key transparency and regulatory disclosures. If these gaps are concerning to you, it may be best to proceed with caution or avoid the service altogether.

For greater security, consider regulated alternatives such as banks or licensed financial institutions that offer clearly defined exchange processes and client protections.

Always prioritize working with licensed and transparent platforms to safeguard your funds and ensure reliable service.