Table of Contents

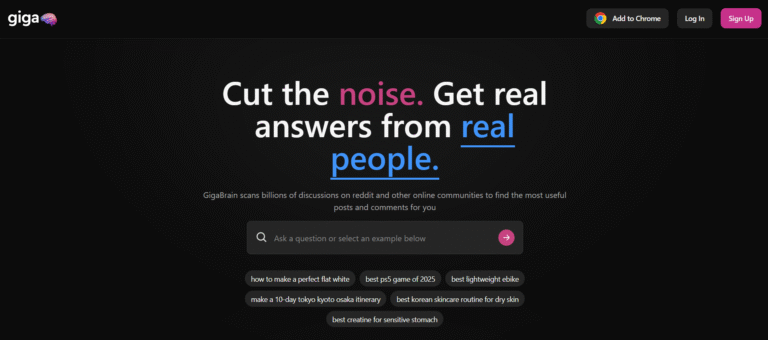

Introduction to GIGA

This article is a detailed review of GIGA (also seen as “Giga”, “Giga Invest”, “Giga Markets”, or similar names), focusing on whether there are genuine concerns of a GIGA scam or whether the operation is legitimate. In this GIGA review, I’ll cover what the broker claims, its regulatory claims, user complaints, and all the warning signs people who suspect is GIGA a fraud or is GIGA a scam should know.

The broker claims to offer a variety of financial services, including forex/CFD trading, social trading, cryptocurrency trading, and sometimes fixed-return investment products. It advertises different account types (from entry to “VIP”), various deposit/withdrawal methods, and supposedly high returns. The claimed registration jurisdictions vary depending on the version of the site: sometimes it claims to have offices in London or Canada, or affiliation with entities like “SIG North Trading”, or claims of registration under regulatory authorities. Because of these mixed signals, many wonder: is GIGA a scam or is it more trustworthy than its critics claim? This GIGA review digs into the evidence so you can decide before risking money with GIGA.

The article is especially for two groups: (1) those who believe they’ve already been scammed by GIGA and want actual information about whether GIGA is legit or not, and (2) those considering using the broker and feeling suspicious, wanting to avoid fraud before depositing. I know you might feel angry, distrustful, or cautious—and this review aims to speak to those feelings by showing what real data exists. This GIGA review uncovers all the warning signs you need to know.

GIGA: Regulation & Legal Status

One of the most critical aspects when evaluating is GIGA a scam is its regulation or legal oversight.

- Several sources indicate that GIGA / Giga Invest / Giga Markets is not regulated by any top-tier regulator. BrokerChooser, for example, flags Giga Invest as “not considered a trusted service provider” because it lacks oversight by a strict financial authority.

- Traders Union similarly reports that GIGA is not regulated at all—and identifies it as carrying significant risks due to unauthorized operations.

- GIGA Markets has been warned by the UK’s Financial Conduct Authority (FCA) under “GIGA – Markets” as possibly providing or promoting financial services without permission. The FCA’s Warning List states that this firm is not authorised, meaning if you use them, you won’t be protected by UK legal frameworks like the Financial Ombudsman or compensation schemes.

Misleading References and False Claims

- Giga Markets claims regulatory affiliation with entities like “SIG North Trading” and “CIRO”, but those claims are contradicted by searches in official registries. True Broker Vision finds no listing of SIG North Trading tied to GIGA in the CIRO register.

- The broker’s website reportedly lists a London address, but investigations find that address likely fabricated or non-functional (no evidence of a functioning brokerage office there).

Risks of Unregulated Brokers

- Without real regulation, there is no mandatory oversight of how client funds are handled. No guarantee of fund segregation.

- Dispute resolution is weak or non-existent. If the broker refuses to pay out or misbehaves, you may be unable to force remediation.

- Clients are exposed to higher risk of manipulation, false promises, hidden fees, or even loss of entire deposit.

Learn how to spot a scam broker before it’s too late by checking regulatory databases, warning lists, and verifying claims.

The lack of oversight raises serious questions about whether GIGA is a scam.

Trading Conditions & Platform Analysis of GIGA

Even if a broker looks flashy, the trading conditions and platform details often expose whether is GIGA a fraud or not.

What GIGA Claims vs What Is Confirmed

| Feature | Claimed by GIGA | What Is Verified / Issues |

|---|---|---|

| Account Types | Multiple types: entry to VIP accounts, supposedly scaled benefits. | Minimum deposit levels claimed (e.g. moderate wording) but precise terms are vague; no independent verification of benefits or actual conditions. |

| Trading Assets | Forex, commodities, cryptocurrencies, sometimes arbitrage, social trading, fixed return-investment style offers. | The detailed schedule of spreads, leverage, order types, execution policies are not clearly published or independently audited. Some claims sound unrealistic. |

| Platform / Tech | WebTrader / possibly MetaTrader in some descriptions; research tools, many “order types” claimed (over 90 in some reports). | But independent reviews say that what users see is a browser-based platform, with large spreads, unclear leverage, and missing clear proof of STP/ECN or good liquidity providers. |

Red Flags

- Unrealistic promises: fixed returns, overly high profits, low or no risk promote suspicion. Genuine brokers always disclose risk.

- Hidden or missing details: withdrawal fees or processing times are vague or not given clearly.

- Domain age vs claimed history: For example, GIGA Markets claims to have been operating since ~2020 or earlier, but domain registration began more recently. Discrepancy in “since …” claim vs WHOIS record.

What to check before signing up with a trading platform:

- Proof of regulation (license number + regulator’s registry)

- Transparent fee / spread / leverage disclosure

- Verified execution model (STP/ECN or not)

- Real reviews of performance and withdrawals

These gaps make it harder to dismiss the idea that GIGA might be a fraud.

Reputation & User Reviews About GIGA

To figure out is GIGA a scam, looking at what users are saying and what independent aggregators report is essential.

- Traders Union reports GIGA has “unauthorized operations” and “reports of fraudulent activities.”

- BrokerChooser also warns about GIGA because it lacks regulation by a top-tier regulator.

- True Broker Vision highlights that GIGA Markets uses fake awards, falsely claimed registrations, invented office locations; overall user feedback is strongly negative.

- From the “TraderKnows” source, we see points such as very low website authority (poor traffic metrics, few keywords ranking, almost no organic reach), indicating lack of widespread established user base.

Specific Complaints

- Withdrawal issues: some users say they’ve made requests but have had delays or have not received funds.

- Customer service problems: email addresses inactive or unresponsive, phone numbers given but unverifiable.

- Marketing methods: high-pressure marketing, affiliate promotions, offers that sound too good, or guaranteeing returns.

Given these reputation signals, many independent analysts lean toward classifying GIGA as high-risk, possibly fraudulent in behavior. This supports serious concern about is GIGA a fraud.

How to Test Whether GIGA Is a Scam

If you suspect that GIGA may be fraudulent—or simply want to be safe—here are steps you can take to test its legitimacy. These apply whether you’re already involved or considering involvement.

- Check for regulation

- Search official regulator registries: FCA (UK), ASIC (Australia), CySEC (EU), others. If GIGA is claimed to be regulated, find the license number and verify it on the regulator’s website.

- Avoid relying only on website statements; many unregulated brokers copy regulatory logos or misstate affiliations.

- Look for red flags in the website and claims

- Discrepancies between claimed history vs domain age.

- Fake or unverifiable address.

- Claims of “guaranteed profits” or “fixed returns with no risk.”

- Pressured deposit requests, or affiliate-driven promotions with big promises.

- Read real user reviews

- Go to Trustpilot or other review aggregators. But be skeptical: many reviews might be fake. Look for detailed, dated, consistent reviews.

- Also watch forums like Forex Peace Army, Reddit – see whether multiple people describe similar issues (withdrawal trouble, support failure, etc.).

- Test withdrawals before investing heavily

- Deposit the minimum, trade a bit, then try withdrawing. If withdrawal is delayed, refused, or fees are not disclosed, it’s a strong red flag.

- See the terms & conditions to check if there are clauses that restrict or penalize withdrawals.

- Inspect the trading conditions carefully

- Are spreads, execution speeds, order types clearly described?

- Is leverage extremely high without risk warnings?

- Is there transparency about liquidity providers or how price feed is managed?

- Use verification tools and blacklists

- Check sites like Scam-Detector for GIGA’s validator report.

- Use Scamdoc.com to see trust score and risk indicators.

- Check eveninsight.com safety checker, etc.

- Try the demo / small test

- If a “demo account” is offered, use it first.

- If there’s no demo or it’s restricted, note that as warning.

By going through these steps, many suspicious properties of GIGA can be uncovered. Doing this gives you better chance to avoid becoming another person asking is GIGA a scam after loss.

Final Verdict & Alternatives

Verdict

After reviewing the evidence:

- GIGA (Giga Invest / Giga Markets etc.) has many red flags: no credible regulation, misleading claims about registration or regulatory affiliation, fraudulent addresses, unclear trading conditions, and repeated user complaints about withdrawals and communication.

- The weight of evidence suggests that GIGA is not trustworthy. The high-risk traits outweigh any claimed benefits.

- Therefore, if you are thinking about depositing money with GIGA, or if you already have and are struggling with withdrawing, you should be extremely cautious. Based on what is publicly verifiable, it is reasonable to conclude that GIGA might well be a scam or at least a fraud risk.