Table of Contents

Introduction to Finwave

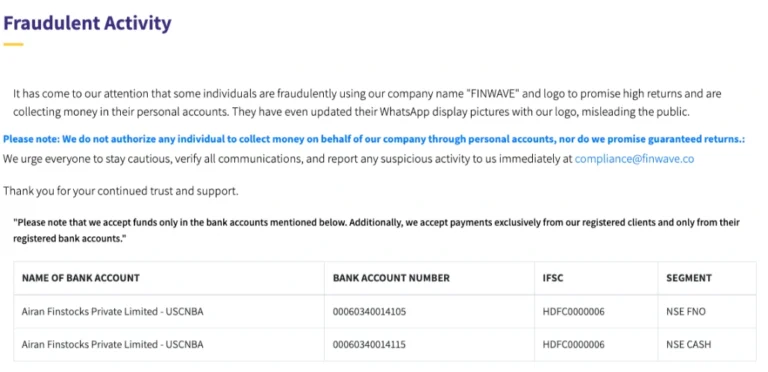

This detailed Finwave review examines whether Finwave scam claims are credible. The broker promotes access to forex, commodities, indices and crypto, and purports to be backed by an Indian entity (Airan Group) with services offered via finwave.group and finwave.co (Fraud Reviews, Wikibit Forex). But with no publicly verified licensing, many ask: is Finwave a scam or a legitimate trading platform? This Finwave review uncovers warning signs you need to know.

Our target readers: those who feel angry or frustrated after being scammed by Finwave and who now seek real information, and those who suspect Finwave might be risky before depositing funds. This article speaks directly to those emotions—your distrust and need for truth.

Finwave: Regulation & Legal Status

Finwave is unregulated—no license from FCA, ASIC, CySEC, or other established authorities (Wikibit Forex). Its website gives little credible company details, just a vague Australian phone code and unverifiable address claims (Fraud Broker 2024). Some sources even reveal fabricated U.S. addresses or offices that don’t exist (FriendlyBroker).

Unregulated status means no oversight, no client-fund insurance, and no dispute resolution. Operators can alter platform data, delay or deny withdrawals, and vanish without accountability. Similar brokers employ pressure tactics, fabricated success stories, and hidden fees—common fraud patterns across unlicensed platforms (Reddit). Learn how to spot a scam broker before it’s too late. The lack of oversight raises serious questions about whether Finwave is a scam.

Trading Conditions & Platform Analysis of Finwave

Finwave’s website claims low account minimums (some say $1) and high leverage—e.g. 1:200—while only offering a basic web‑trader, not MT4/MT5 or ECN/STP execution (Fraud Broker 2024). There’s no transparency around liquidity providers or execution speed. Unrealistic profitability claims and vague terms are red flags.

Even if a broker offers MT5, that alone doesn’t prove trustworthiness. Many scammers rent generic platforms and manipulate figures. What to check before signing up with a trading platform. These gaps make it harder to dismiss the idea that Finwave might be a fraud.

Reputation & User Reviews About Finwave

On Trustpilot, Finwave.group has mostly positive “invited” reviews, but 13% are 1‑stars declaring outright “It’s a scam,” with reports of fake regulatory claims and crypto‑only deposits, leaving users unable to withdraw (Reddit, Trustpilot).

Independent reviews on Forex watchdog sites warn Finwave lacks licenses, shows fake addresses, and operates with deceptive marketing language (Financial Reviews by Experts). Others report that early small withdrawals are allowed—to build trust—before refusing sizable withdrawals entirely (ForexMetaTrade, Fraud Broker 2024).

Further, on ForexWiki, Finwave scores extremely low (1.55/10)—indicative of high scam risk—and reviews cite unclear fees, withdrawal issues, and platform manipulation (Wikibit Forex). The consistency of complaints across multiple sources points firmly in the same direction.

How to Test Whether Finwave Is a Scam

If you feel uneasy, here’s a checklist that echoes investigative and emotional needs:

- Check for regulation: Search FCA, ASIC, CySEC register—Finwave does not appear on any of them.

- Look for red flags: Vague or missing license details, fake addresses, domain created recently (domain launched April 2024) (Wikibit Forex).

- Read real user reviews: TrustPilot red flags, forums like Forex Peace Army or Reddit echo withdrawal and trust issues.

- Test demo and withdrawal terms: Legit brokers allow demo use and clear withdrawal rules—not crypto‑only or blocked access.

- Watch for false promises: Any guarantee of high returns with no risk is unrealistic and suspicious.

- Evaluate website/platform: Poor site design, generic trading interface, limited tools suggest low legitimacy.

Take time to go paragraph by paragraph, feeling the frustration of potential users. This is how you protect your hard-earned money—step by step, fully aware.

Final Verdict & Alternatives

Final Verdict: Finwave exhibits multiple red flags—no regulation, no verifiable transparency, mixed and suspicious user reviews, domain launched in 2024, and coercive marketing tactics. Based on credible reports across independent platforms, we strongly recommend avoiding Finwave.

If you’ve already deposited funds, consider contacting your bank for a chargeback, gather all communications, and report to authorities—or seek consumer fraud recovery services promptly (Reddit, ForexMetaTrade).

Reputable Alternatives: Consider brokers regulated by FCA (UK), ASIC (Australia), CySEC (Europe) or NFA/CFTC (USA). Examples: IG, OANDA, eToro, Interactive Brokers—trusted, licensed, transparent, and with strong track records. Only trade with licensed platforms to ensure your money is protected.

Stay cautious, informed, and in control.

If you’re dealing with anger or loss from Finwave, you’re not alone—and you deserve clear, unbiased information. Let me know if you’d like a comparison on alternative brokers or help restoring funds.