Table of Contents

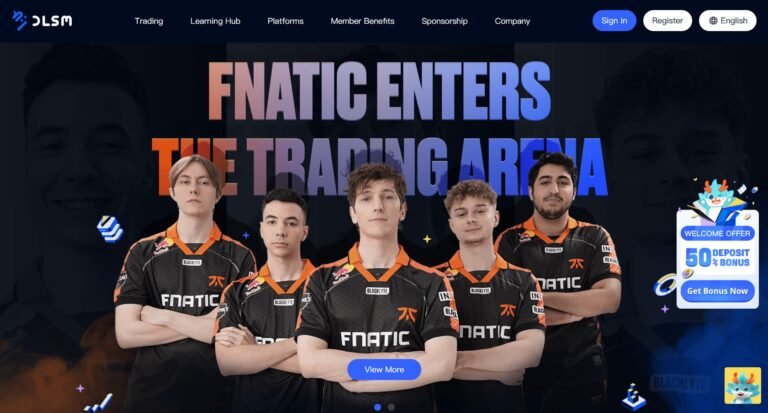

Introduction to DLSM

This DLSM review aims to uncover the truth behind this broker’s operations and credibility. Many traders are questioning whether DLSM is a scam due to mounting concerns about its licensing, transparency, and handling of customer funds.

The company claims to provide advanced trading solutions for global clients, but the lack of verifiable details raises red flags.

If you’ve been scammed by DLSM or are considering opening an account and want to confirm whether this broker is legitimate, this review is tailored for you. This DLSM review uncovers all the warning signs you need to know.

DLSM: Regulation & Legal Status

The first step in determining a broker’s legitimacy is verifying its license. Unfortunately, DLSM does not appear to be regulated by any reputable authority such as the FCA (UK), ASIC (Australia), or CySEC (EU). Instead, it seems to operate through offshore entities, which often lack stringent oversight.

Trading with unregulated brokers exposes investors to serious risks, including no fund protection, no dispute resolution mechanisms, and no accountability. Misleading references to respected regulators are a common tactic used by questionable brokers to appear legitimate.

Learn how to spot a scam broker before it’s too late. The lack of credible licensing raises strong concerns about whether DLSM is a scam.

Trading Conditions & Platform Analysis of DLSM

Legit brokers provide clear details about their trading conditions. However, DLSM offers very little transparency about its account types, minimum deposits, leverage, or spreads.

Claims about offering sophisticated platforms are vague, with no verification of actual platform availability or functionality. Even if DLSM provides access to MT4 or MT5, it’s important to remember that having these platforms does not make a broker trustworthy.

Another concern is the absence of any information about liquidity providers or execution models (STP/ECN), which makes it difficult to verify whether clients’ trades are handled fairly.

Promises of high leverage and “guaranteed profits” are also classic red flags.

What to check before signing up with a trading platform. These omissions make it harder to dismiss the possibility that DLSM might be a fraud.

Reputation & User Reviews About DLSM

Examining DLSM across review platforms reveals troubling trends. Traders have reported withdrawal problems, poor customer support, and aggressive sales tactics.

Some reviews on platforms like TrustPilot appear overly positive and generic, which may indicate the use of fake testimonials to mask negative feedback.

Traffic analytics from sites like SimilarWeb show limited user engagement, which raises further doubts about the broker’s legitimacy. A reputable global broker typically has consistent web traffic and community discussions, which DLSM lacks.

How to Test Whether DLSM Is a Scam

If you’re unsure whether DLSM is legitimate, follow these steps:

- Verify licenses: Check if DLSM is registered with reputable regulators like the SEC, FCA, or ASIC.

- Look for red flags: Missing or unclear regulatory details are a major warning sign.

- Check real reviews: Read feedback on independent sites like Forex Peace Army and avoid relying on testimonials on the broker’s own site.

- Test the platform: Poorly designed or inaccessible platforms can be a scam indicator.

- Review withdrawal policies: Be cautious of brokers that only allow crypto withdrawals or impose unreasonable conditions.

- Be wary of promises: “Guaranteed profits” and high-pressure tactics usually signal fraud.

- Use a demo account: Legit brokers provide a demo account without requiring deposits.

Final Verdict & Alternatives

So, is DLSM a scam? Based on the evidence—no regulation, lack of transparency, and numerous customer complaints—we strongly advise avoiding this broker.

Trading with unregulated platforms puts your money at high risk.

If you’ve already lost funds to DLSM, report DLSM for fraud and seek help from recovery specialists. For safer trading, choose licensed brokers regulated by top-tier authorities like the FCA, ASIC, or CySEC.