Table of Contents

Introduction to Cambridge Currencies

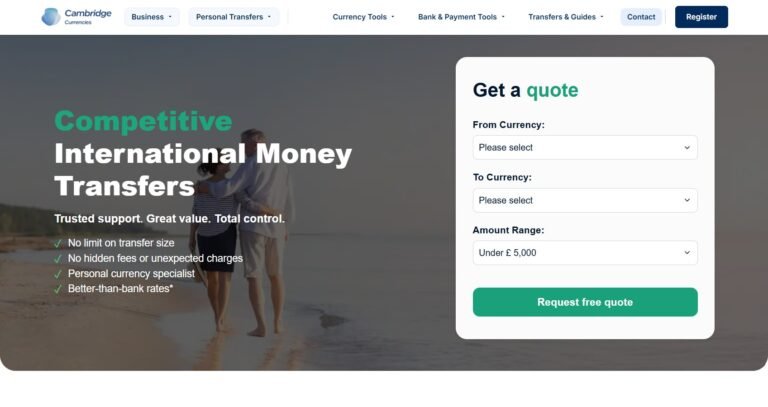

This article provides a thorough Cambridge Currencies review, addressing concerns surrounding the Cambridge Currencies scam claims online. Cambridge Currencies markets itself as a global broker offering Forex, cryptocurrencies, and CFD trading with competitive spreads and advanced trading tools. The broker claims registration in Saint Vincent and the Grenadines.

But the critical question remains: is Cambridge Currencies a scam or a legitimate trading platform? This Cambridge Currencies review uncovers essential warning signs you need to be aware of before investing your money.

Our target audience includes individuals who may have been scammed by Cambridge Currencies and want verified information to assess its legitimacy. We also speak to those suspicious of the broker before depositing funds. This article aims to acknowledge the emotional and financial stress these users may face while providing clear, factual insights.

Cambridge Currencies: Regulation & Legal Status

Cambridge Currencies is registered in Saint Vincent and the Grenadines, a jurisdiction with minimal financial oversight. Unlike brokers regulated by authorities such as the FCA, ASIC, or CySEC, Cambridge Currencies lacks formal licensing from any top-tier regulator. This absence means clients are exposed to risks including no regulatory oversight, no client fund protection, and no dispute resolution mechanisms.

Some brokers in similar offshore zones attempt to mislead clients by referencing top regulators or using unofficial disclaimers. To protect yourself, you can learn how to spot a scam broker before it’s too late and verify broker credentials carefully.

The lack of oversight raises serious questions about whether Cambridge Currencies is a scam or merely an unregulated, risky broker.

Trading Conditions & Platform Analysis of Cambridge Currencies

Cambridge Currencies offers several account types with minimum deposits reportedly starting at $250. The broker promotes leverage up to 1:500 and provides access to popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). While MT5 is a well-known platform, its presence alone doesn’t guarantee broker trustworthiness.

Details on spreads, execution quality, and liquidity providers are sparse or unclear. There is no transparent confirmation whether the broker uses ECN or STP trading models, which are important indicators of fair trade execution. Promises of high leverage and “no risk” trading should be viewed cautiously.

Before opening an account, consider what to check before signing up with a trading platform. These missing details make it difficult to dismiss the idea that Cambridge Currencies might be a fraud.

Reputation & User Reviews About Cambridge Currencies

Review platforms such as Trustpilot show mixed and often suspiciously positive feedback, which could be fake or incentivized. Many users report withdrawal delays, poor customer support, and account freezes.

Traffic data from SimilarWeb indicates moderate site visits, but online engagement doesn’t necessarily equal legitimacy. Patterns of unverifiable testimonials and repeated user complaints about fund access raise serious concerns.

How to Test Whether Cambridge Currencies Is a Scam

Start by verifying regulatory licenses with official authorities like FCA, ASIC, or CySEC. Missing or vague licensing is a critical warning sign. Check real user experiences on sites like Forex Peace Army or Trustpilot, but remain cautious of fake reviews.

Assess the website and platform design — poor usability or unfamiliar trading software may indicate fraud. Scrutinize withdrawal policies; if only crypto payments are allowed or terms are unclear, that’s a red flag.

Beware of unrealistic promises such as guaranteed profits with zero risk. Legitimate brokers typically offer demo accounts so you can test the platform risk-free before investing.

Final Verdict & Alternatives

Considering regulatory concerns, transparency issues, and mixed user reviews, it’s advisable to approach Cambridge Currencies with caution. The potential risks outweigh the benefits for most traders, especially beginners.

For safer trading, consider established, regulated brokers like IG, FXTM, or Pepperstone, which provide investor protections and transparent conditions.

Always prioritize licensed brokers to protect your investments and avoid scams.