Table of Contents

Introduction to AxiTrader

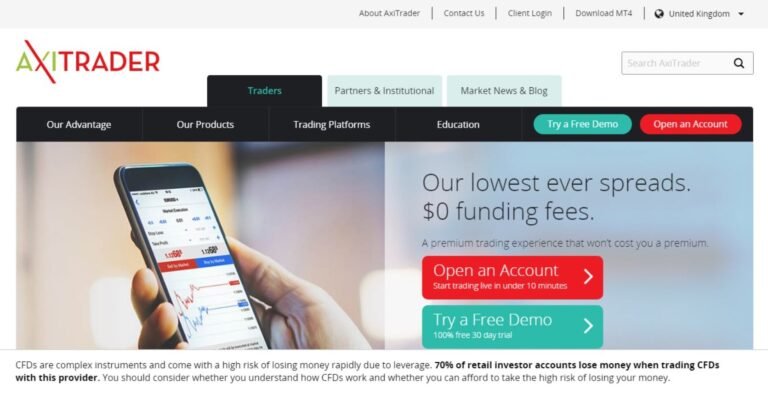

This AxiTrader review examines the broker’s offerings, claimed licenses, and overall reputation in the trading industry. AxiTrader markets itself as a globally recognized Forex and CFD broker, claiming registration in Australia and the UK. It promotes access to competitive spreads, advanced platforms, and professional support.

However, past complaints from users — including difficulties with withdrawals and concerns about transparency — raise questions: is AxiTrader a scam or a legitimate trading platform? This AxiTrader review uncovers all the warning signs you need to know.

AxiTrader: Regulation & Legal Status

AxiTrader claims regulation under the Australian Securities and Investments Commission (ASIC) and the UK’s Financial Conduct Authority (FCA), which are reputable regulatory bodies. While this offers some credibility, users must ensure their account falls under these regulated entities, as some services may be operated from offshore subsidiaries with weaker oversight.

It’s important to verify regulatory claims directly with the official databases. Unregulated brokers or those using offshore registrations often expose clients to risks like no dispute resolution, lack of funds protection, and limited recourse in case of fraud. Learn how to spot a scam broker before it’s too late. While AxiTrader presents itself as regulated, users should still exercise caution when dealing with any broker that operates under multiple entities. The lack of clarity in certain operations leaves open the question of whether AxiTrader is a scam.

Trading Conditions & Platform Analysis of AxiTrader

AxiTrader offers access to MetaTrader 4 (MT4), a widely used trading platform. It provides several account types with variable spreads and leverage options reportedly up to 1:500 for certain clients. While the high leverage may appeal to experienced traders, it can significantly increase trading risks, especially for retail clients.

The broker does not provide full transparency about its liquidity providers or whether it uses a true STP/ECN model. Additionally, while offering MT4 is a positive sign, this alone does not guarantee the safety or reliability of a broker. Before committing funds, make sure to review what to check before signing up with a trading platform. These gaps make it harder to dismiss the idea that AxiTrader might be a fraud.

Reputation & User Reviews About AxiTrader

User reviews about AxiTrader are mixed. On TrustPilot, many traders praise its platform reliability and customer service. However, some customers report delays in withdrawals, inconsistent support responses, and unexpected account restrictions.

This combination of positive but unverifiable reviews alongside serious complaints is common in the brokerage industry, often leaving retail traders uncertain about whom to trust. Traffic analysis on SimilarWeb shows steady global visits, suggesting an established user base, but that doesn’t erase concerns shared by dissatisfied clients.

How to Test Whether AxiTrader Is a Scam

Before depositing funds with AxiTrader or any broker, take these precautionary steps:

- Verify the license: Check the ASIC and FCA databases to confirm AxiTrader’s regulatory claims.

- Spot red flags: Be cautious if key details about account handling or fees are vague.

- Review independent feedback: Consult sites like TrustPilot and Forex Peace Army for real user experiences.

- Test the platform: Ensure functionality and reliability before committing large deposits.

- Assess withdrawal policies: Avoid platforms that delay or complicate withdrawals.

- Be wary of promises: Ignore any claims of guaranteed profits or risk-free trading.

- Use a demo: Legitimate brokers let you try their platforms with virtual funds first.

Final Verdict & Alternatives

While AxiTrader presents itself as a regulated broker with competitive trading conditions, the mixed user feedback and lack of transparency in some areas warrant caution. If you are a retail trader prioritizing fund safety, you may want to consider alternatives with a clearer operational framework and stronger consumer protections.

We recommend sticking with fully licensed brokers operating under strict jurisdictions like the FCA, ASIC, or CySEC. These platforms offer more robust oversight, clearer dispute resolution, and a stronger commitment to trader security.