Table of Contents

Introduction to AGlobalTrade

This article provides a detailed AGlobalTrade review, examining allegations of the AGlobalTrade scam and the legitimacy of its operations. AGlobalTrade presents itself as an online trading platform offering forex, commodities, and CFDs with competitive spreads and advanced trading tools. While it claims to be an international broker, details about its registration point to offshore jurisdictions, which raises critical concerns.

Many traders are left wondering: is AGlobalTrade a scam or a trustworthy platform for investing? If you’ve been burned by suspicious practices or are skeptical about depositing your hard-earned money, this AGlobalTrade review uncovers the red flags you need to know.

AGlobalTrade: Regulation & Legal Status

AGlobalTrade claims to operate under international trading standards, but there’s little evidence of proper regulation by any reputable financial authority such as the FCA, ASIC, or CySEC. The lack of verifiable licensing information suggests that the company is either unregulated or only registered in an offshore jurisdiction with minimal oversight.

Unregulated brokers pose serious risks: no investor protection, no third-party dispute resolution, and no compensation if funds are misused. These are classic hallmarks of high-risk brokers. Many similar platforms use deceptive tactics, including false licensing claims and misleading “regulatory badges,” to appear legitimate.

Learn how to spot a scam broker before it’s too late. The absence of credible oversight raises valid concerns about whether AGlobalTrade is a scam.

Trading Conditions & Platform Analysis of AGlobalTrade

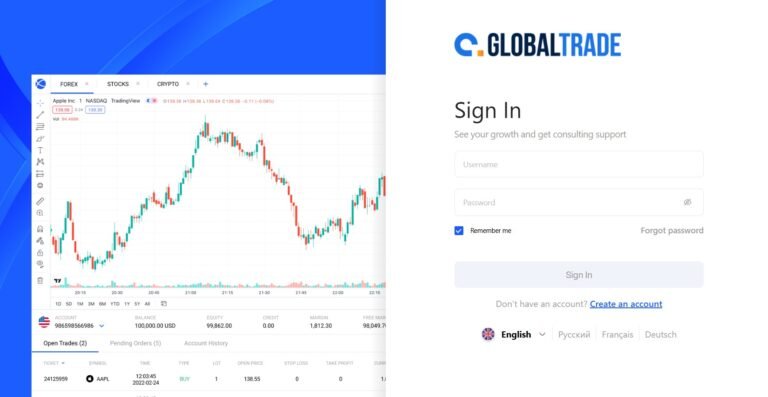

AGlobalTrade advertises multiple account types with low minimum deposits and leverage up to 1:500 — an unusually high figure that often signals elevated risk. The spreads and fees are not transparently disclosed, and there is little information about order execution, liquidity providers, or whether they use an STP or ECN model.

While the broker promotes access to well-known platforms like MT4 or MT5, simply offering these platforms does not guarantee reliability or fairness. Legitimate brokers provide clear, verifiable details about execution policies and fees — which AGlobalTrade fails to do.

What to check before signing up with a trading platform. The lack of clarity on core trading conditions makes it difficult to rule out the possibility that AGlobalTrade might be a fraud.

Reputation & User Reviews About AGlobalTrade

Online feedback about AGlobalTrade is mixed, with multiple complaints on review sites such as TrustPilot and Forex Peace Army. Common grievances include delayed withdrawals, unresponsive customer service, and aggressive sales tactics. Several reviewers also allege account freezes after requesting payouts — a frequent red flag in broker scams.

Some reviews appear overly positive and lack depth, which could indicate fabricated testimonials. Genuine brokers usually have a balanced mix of transparent reviews, but AGlobalTrade’s reputation raises more questions than answers.

How to Test Whether AGlobalTrade Is a Scam

Before committing funds, perform these checks to safeguard yourself:

- Check regulation: Verify any claimed licenses directly with authorities like the FCA, ASIC, or CySEC.

- Spot red flags: Watch for vague or unverifiable licensing claims.

- Read real reviews: Look for recurring issues on sites like TrustPilot or Forex Peace Army.

- Test the platform: Evaluate the site’s quality — poorly designed platforms often indicate scams.

- Understand withdrawal terms: Lack of transparency or crypto-only withdrawals is concerning.

- Avoid false promises: Guaranteed profits are a major red flag.

- Try the demo: Reputable brokers provide full-featured demo accounts without conditions.

Following these steps can help you decide whether AGlobalTrade is a safe broker or if you’re at risk of dealing with a fraudulent operation.

Final Verdict & Alternatives

Final Verdict: Based on its lack of regulatory credentials, unclear trading conditions, and troubling user feedback, we advise extreme caution with AGlobalTrade. The risks outweigh the benefits, making it unsuitable for traders who value safety and transparency.

Alternatives: For safer trading, consider brokers with strong regulatory oversight such as:

- IG Markets – FCA & ASIC regulated

- Interactive Brokers – CFTC & FCA regulated

- Forex.com – NFA & FCA regulated

These alternatives provide better transparency, client protection, and regulated trading environments.